美版“拼多多”–“Wish”登陆纳斯达克,上市首日即破发16.5%(wish跨境电商正式推出)

北京时间12月16日晚,美国跨境电商Wish的母公司ContextLogic正式在美国纳斯达克交易所挂牌上市,股票代码(NASDAQ: WISH),发行4600万股,募资约11亿美元wish跨境电商,首个交易日即跌破发行价,最终收跌16.4%,股价报20.05美元,市值117.58亿美元。

Wish在2013年进入外贸电商领域wish跨境电商,专注于移动APP运营,主要瞄准美国的“下沉市场”——三四线城市的买家,出售“物美价廉”的小物件,比如女装、手表、球鞋和首饰,平台卖家多数来自于亚洲。

根据MarketplacePluse数据统计,Wish用户中94%卖家来自于中国,广东卖家占27%,堪称美版“拼多多”。

E-commerce firm ContextLogic Inc sold shares in its initial public offering (IPO) on Tuesday at $24 apiece, the top of its target range, to raise $1.1 billion, the company said in a statement.

The IPO gives ContextLogic, which does business as Wish, a market capitalization of $14.1 billion. Wish had planned to sell 46 million shares within a targeted range of $22 and $24 per share. Wish stock plunged 16.5%, closing at 20.05 USD on December 16, 2020.

美版“拼多多”的核心竞争力是?

Wish成立于硅谷,由加拿大华人张晟和其在加拿大滑铁卢大学的校友Peter Szulczewsk创办,前身是名为ContextLogic的技术服务公司,面向移动端广告业务。

Peter Szulczewiki和张晟曾不满谷歌搜索算法陈旧僵化,合力优化算法。

相比于亚马逊更加注重搜索功能的完善,Wish则强调算法驱动。

Wish会根据用户和商家的行为来进行“大数据杀熟”,更好地促成买家和卖家之间的匹配度。

迄今,Wish一共融资16亿美元,投资者包括泛大西洋投资(General Atlantic)、Founders Fund和GGV Capital等。

Founded in 2010 by former Google executive Peter Szulczewski and Yahoo veteran Danny Zhang, San-Francisco-based Wish has more than 100 million monthly active users worldwide, selling about 2 million products daily on its e-commerce platform, according to the company's website.

Some of Wish's main investors include Yuri Milner's DST Global, Peter Thiel's Founders Fund, Formation8 Partners, GGV Capital, and private equity firm General Atlantic.

Wish shares are due to begin trading on Nasdaq on Wednesday under the symbol “Wish.”

美国疫情尚未得到控制,大部分买家蜗居家里,促成了线上电商Wish的发展,相比于2019年同期,2020年前三季度,无论是整体网站成交金额,还是订单量数字,都实现了稳定增长。

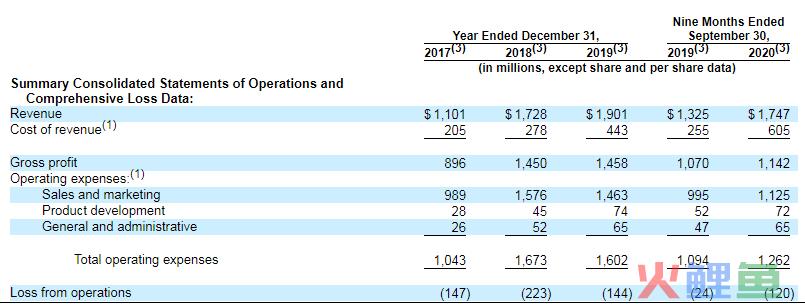

招股书显示,Wish在2017年、2018年、2019年营收分别为11亿美元、17.28亿美元、19亿美元;Wish在2020年前9个月营收为17.47亿美元,上年同期的营收为13.25亿美元。

Wish reported revenue of $1.7 billion for nine months ended in September, up 32 percent from $1.3 billion last year. The company's net losses, however, widened to $176 million compared with $5 million last year.

招股书陈述形势一片大好

为何上市首日即破发16.5%?

Wish的“阿喀琉斯之踵”出现在其仓储物流上。

今年7月,不少卖家反应,Wish平台A+物流时效过慢,导致退款纠纷增多。

“5月份发出的货,到现在运货率不到10%,但是退款率已经超过20%了!”

目前,跨境电商物流市场属于前期扩张时代,存在着价格贵,速度慢,后期追踪,清关慢的政策性难题。

如何学习国内电商巨头,采用合理的信息智能化仓储物流,整合海内外仓储资源,是Wish今后将要面对的难题之一。

Wish's IPO comes as the COVID-19 pandemic led to a surge in online shopping from customers complying with stay-at-home orders. The share offering will also be riding on the tech-fueled rally in U.S. stock markets that has led to blockbuster IPOs of companies such as Airbnb Inc, DoorDash Inc, and SnowFlake Inc.

But why did Wish fall on its first IPO debut?

Wish sells products that customers like based on their past search history, and there are so many complaints about their unauthorized transactions, their shipping time, the difficulty in obtaining a refund, and bad customer service. If these problems get resolved, then it will be easier for Wish to further expand its overseas market.